- v1.0.0-latest-prod

Broadleaf Commerce currently offers integration with Adyen through a commercial integration module. To obtain this third party integration or if you have any questions about this module, please contact us at info@broadleafcommerce.org

This integration requires Broadleaf Release Train 2.2.0-GA or higher, esp. to include CartOperationServices 2.2.0-GA & PaymentTransactionServices 2.0.5-GA.

Create an account with Adyen in order to use the BroadleafCommerce Adyen payment functionality.

A sandbox account can be setup for testing at https://www.adyen.com/signup

Please familiarize yourself with the Adyen docs before proceeding.

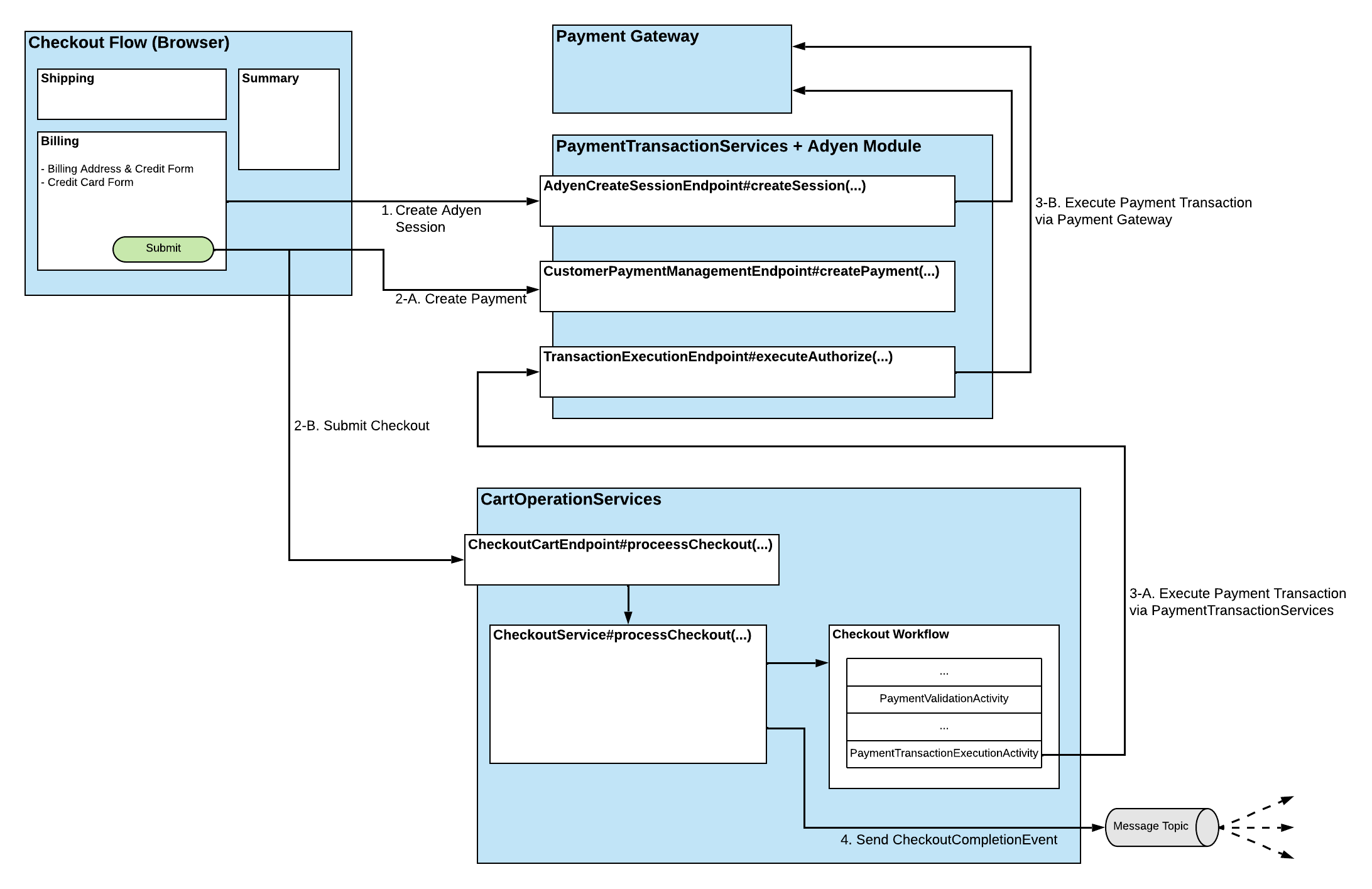

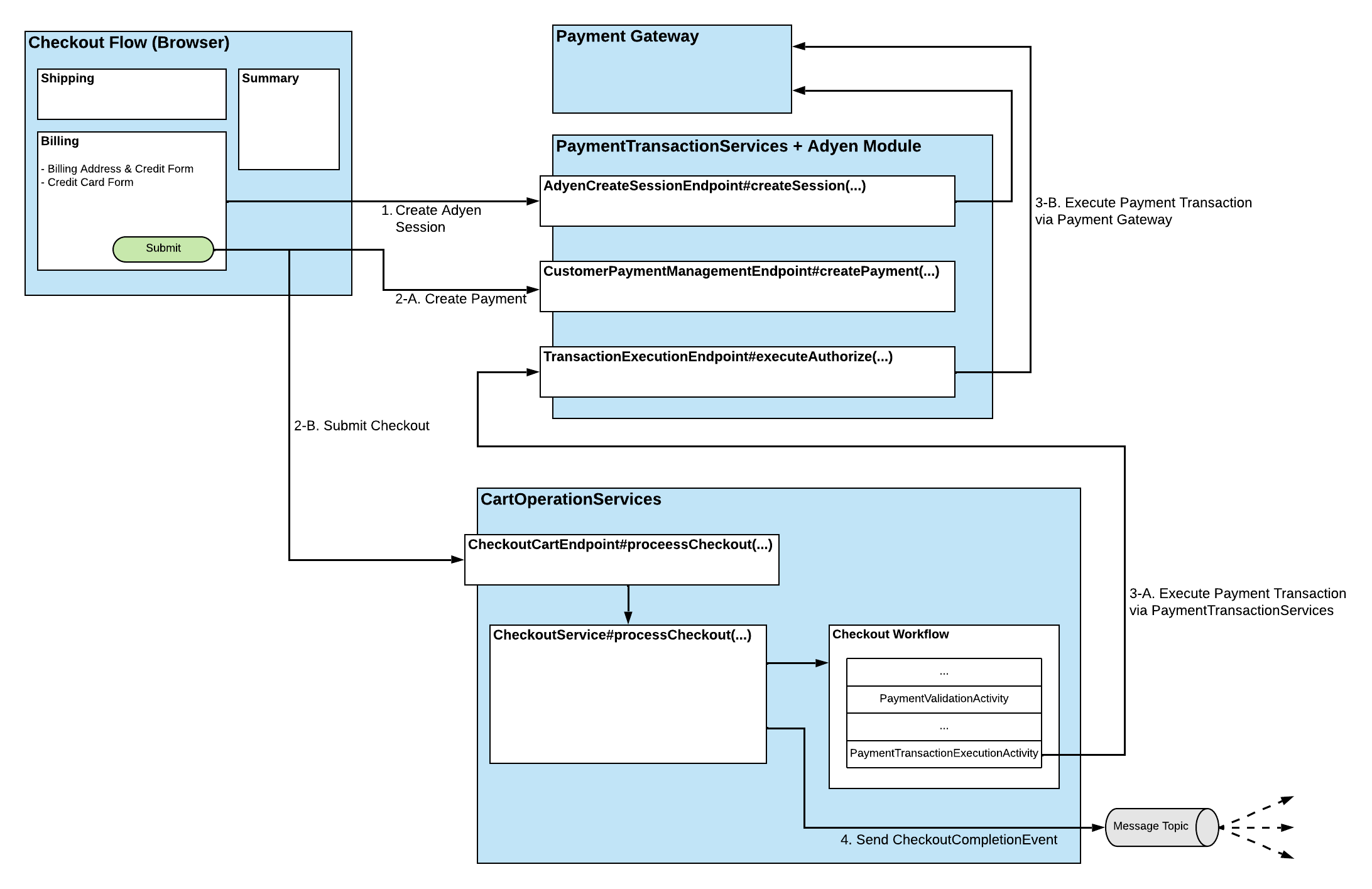

The Adyen integration generally mirrors our typical payment gateway integration pattern, but with a few notable differences:

Coming out of their frontend integrations, payment gateways typically provide you with some style of token - i.e. a unique id that is completely abstracted from the actual payment method. In the case of Adyen, you’re given encrypted card data, including the encrypted CVV. Adyen is the only party aware of the encryption keys, but regardless, we choose to NOT store this encrypted card data when creating a Payment in PaymentTransactionServices. Instead, we choose to pass this data via the CheckoutSubmissionRequest, through CartOps, to PaymentTransactionServices when executing the related checkout payment transactions. This is done so that the encrypted card data is never persisted within the Broadleaf ecosystem.

Also with the intention of not storing encrypted card data via the browser, we intentionally decided to exclude the review stage of our demo checkout flow when using Adyen. Therefore, when the payment stage is submitted via the browser, we create the Payment in PaymentTransactionServices (again, without including encrypted card data), then process checkout via CartOps. If the review stage was present, then the encrypted card data would need to be stored via the browser, until checkout is submitted.

On the frontend, this integration with Adyen was built using the Adyen Drop-In UI to gather credit card & other payment method details in a SAQ-A manner. With that being said, the Adyen Components UI can also be used, as long as it provides the necessary Adyen payment method object is provided when attempting Authorize or AuthorizeAndCapture transactions via PaymentTransactionServices.

Once the initial transaction is executed, all subsequent transactions (i.e. ReverseAuthorize, Capture, & Refund) are triggered using the pspReference provided by Adyen in the Authorize or AuthorizeAndCapture response.

To prepare your environment to execute payment transactions via Adyen, please follow the environment setup guide.

For details on the frontend integration, please follow the Adyen Drop-in UI Integration guide.

Using this library, you can execute the following types of transactions:

For details on how payment methods can be saved for future use, please see the Adyen Saved Payment Methods doc.

For details on the 3DS integration & setup, please see the Adyen 3DS doc.

For details on how ApplePay, GooglePay, & PayPal can be used as a digital wallet with Adyen, please see the Adyen Digital Wallets doc.

For details about buy now pay later via Klarna integration & setup, please see the Klarna doc.